kansas sales and use tax exemption form

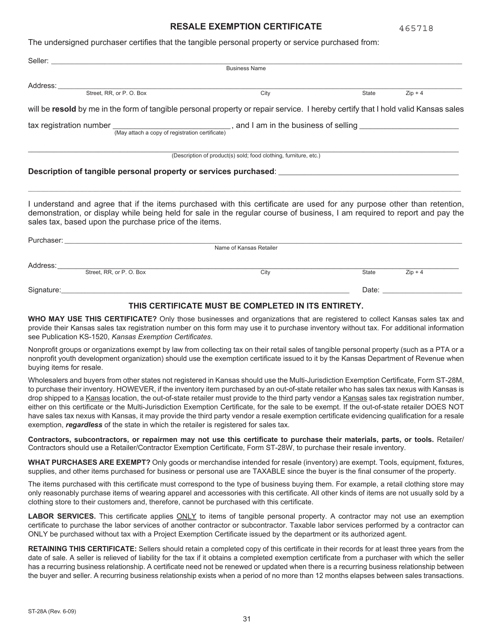

Fill in your choosen form. Step 1 Begin by downloading the Kansas Resale Exemption Certificate Form ST-28A.

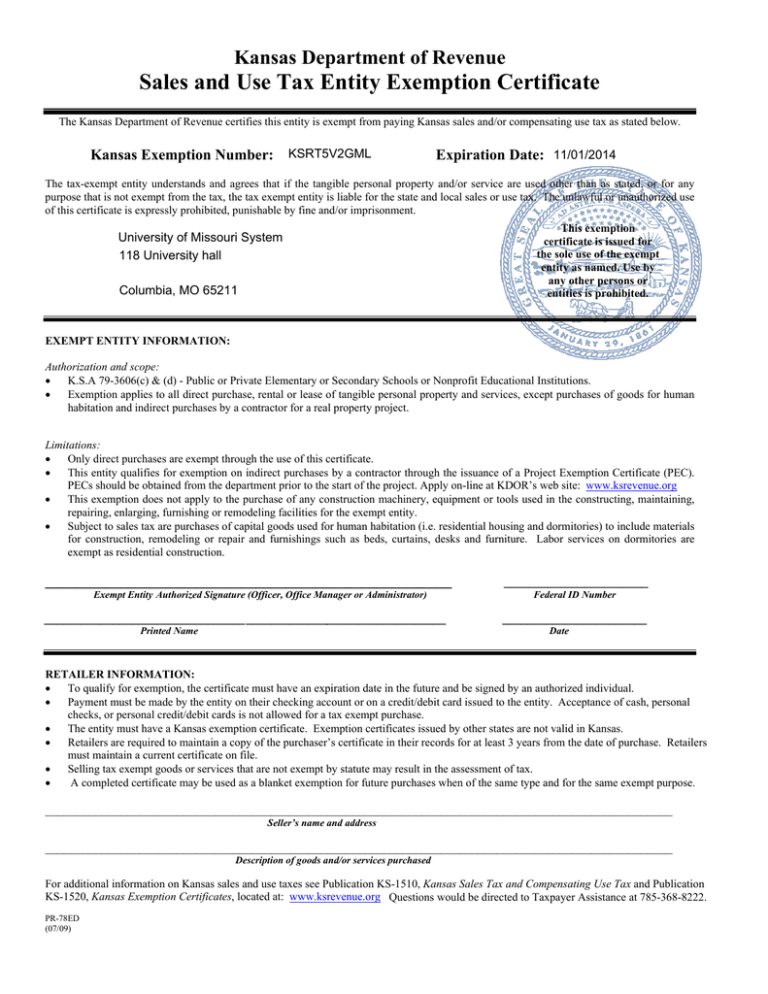

Sales And Use Tax Entity Exemption Certificate Kansas Department Of Revenue

Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 2.

. PART C The retail sale of a work-site utility vehicle may be exempt from Kansas sales tax if it meets all statutory requirements. How to use sales tax exemption certificates in Kansas. It is designed for informational purposes only.

Send to someone else to fill in. For other Kansas sales tax exemption certificates go here. This is a Streamlined Sales Tax Certificate which is a unified form that can be used to make sales tax exempt purchases in all states that are a member of the Streamlined Sales and Use Tax AgreementPlease note that Kansas may have specific restrictions on how exactly this form can be used.

Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. Agricultural ST-28F Aircraft ST-28L. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not.

The certificates will need to be renewed on the departments website. 79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible personal property in a warehouse or distribution facility in Kansas all sales of installation repair and maintenance services performed on such machinery and equipment. Organization that is subject to federal income tax and reported on a federal Form 990-T is subject to Kansas income tax.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. Kansas Department of Revenue-issued tax-exempt entity sales tax exemption certificate showing state-issued exempt organization ID number Form PR-78SSTA. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums dependent on the companys affiliation.

It shows why sales tax was not charged on a retail sale of goods or taxable services. Sales and use tax. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms.

Sign the form using our drawing tool. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law. The premium tax rate for domestic and foreign insurance companies doing business in Kansas is 2 percent.

Barbed wire T-posts concrete mix post caps T-post clips screw hooks nails staples gates electric fence posts electric insulators and electric fence chargers. Fill in and edit forms. Your Kansas Tax Registration Number 000-0000000000-00.

Fill has a huge library of thousands of forms all set up to be filled in easily and signed. On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. And all sales of repair.

SalesTaxHandbook has an additional three. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. Or Designated or Generic Exemption Certificate ST-28 that authorizes exempt purchases of services.

Also the Tax-Exempt Identification Number is separate and apart from a Kansas Sales Tax Registration Number format 004-XXXXXXXXX-F0X required of anyone including exempt entities making retail sales of taxable goods services or admissions in Kansas. Kansas Sales Tax Exemption Certificate information registration support. Give your assigned exemption number where indicated.

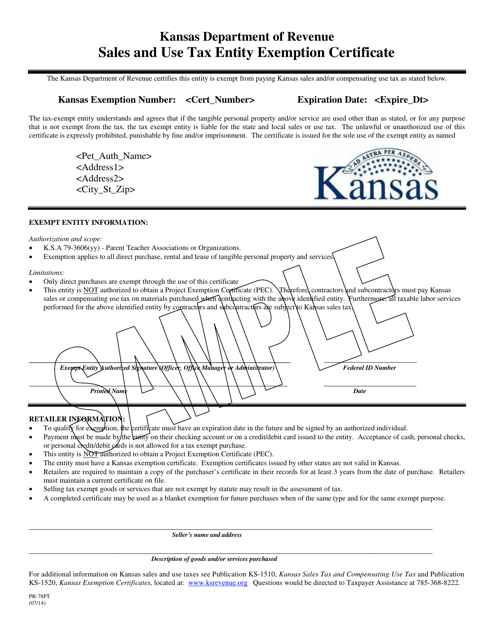

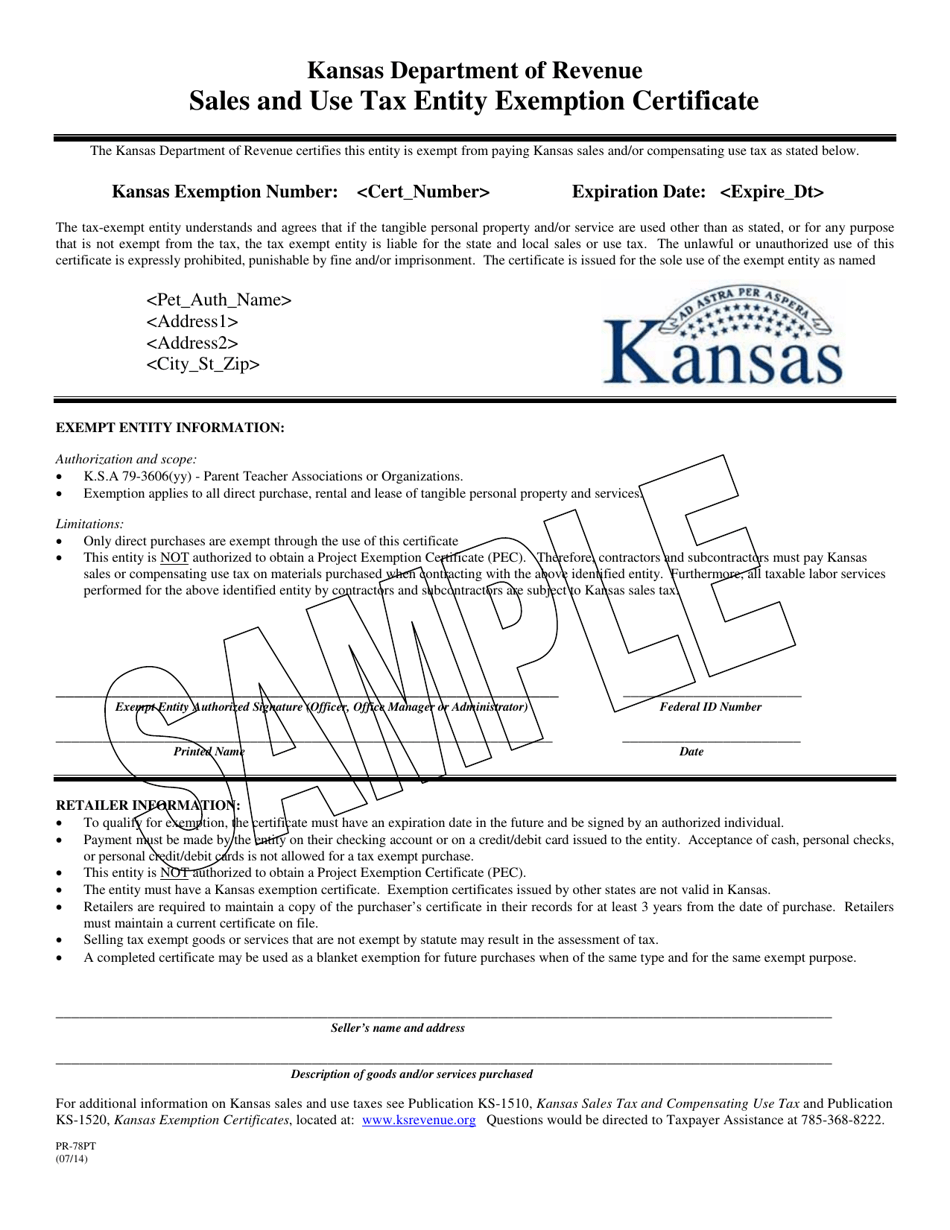

Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 3. Enter the expiration date of your exemption status. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

200 1937 400 1986 530 2002 650 2015. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. You can download a PDF of the Kansas Contractor Retailer Exemption Form ST-28W on this page.

Enter the expiration date of your exemption status. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Download or print completed PDF.

Wholesalers and buyers from other states not registered in Kansas should use. Nonprofit groups or organizations exempt by law from collecting tax on their retail sales of tangible personal property such as a PTA or a nonprofit youth development organization should use the exemption certificate issued to it by the Kansas Department of Revenue when buying items for resale. Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify.

Email Address The email address you used when registering. The buyer completes and furnishes the exemption certificate and the seller keeps the certificate on file with other sales tax records. You may use the State of Kansas exemption certificate exclusively-that is an agency decision.

Kansas Sales And Use Tax Entity Exemption Certificate PR-78D Step 1. Other Kansas Sales Tax Certificates. Password Passwords are case sensitive.

An exemption certificate is a document that a buyer presents to a retailer to claim exemption from Kansas sales or use tax. If you want to. It shows why sales tax was not charged on a retail sale of goods or taxable services.

For non-profits that have received a sales tax exemption certificate from the Kansas Department of Revenue the exemption certificate is good only from its effective date and can have an expiration date. The renewal process will be available after June 16th. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is notFile Size.

Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. The contents should not be used as authority to support a technical position. If you are accessing our site for the first time select the Register Now button below.

Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and Compensating Use Tax exemption certificates. An exemption certificate is a document that a buyer presents to a retailer to claim exemption from Kansas sales or use tax. Burghart is a graduate of the University of Kansas.

The buyer completes and furnishes the exemption certificate and the seller keeps the certificate on file with other sales tax records. Ad New State Sales Tax Registration. Enter the name of your business and its complete address.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The Kansas Retailers Sales Tax was enacted in 1937 at the rate of 2 increasing over the years to the current state rate of 650. Enter the name of your business and its complete.

The entire Form ST-28H including the direct purchase portion must be. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax. Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and Compensating Use Tax exemption certificates.

Still Working Remotely Your 2021 Taxes May Be More Complicated

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Here S The Average Irs Tax Refund Amount By State

Form St 28a Download Fillable Pdf Or Fill Online Resale Exemption Certificate Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

2015 2022 Form Ks Dor Ks 1520 Fill Online Printable Fillable Blank Pdffiller

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Restaurants Not Passing Benefit Of Gst Reduction To Customers Nowadays Social Media Is Abuzz With A Photo Showing Two Reduction Goods And Service Tax Benefit

States Are Imposing A Netflix And Spotify Tax To Raise Money

:max_bytes(150000):strip_icc()/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)