unified estate tax credit 2021

That would occur if certain rules werent met and the overall value of the estate exceeds the annual federal estate tax. The federal estate tax kicks in for estates that are worth more than 117 million in 2021 and 1206 million in 2022 the same amounts as the lifetime gift tax exemption.

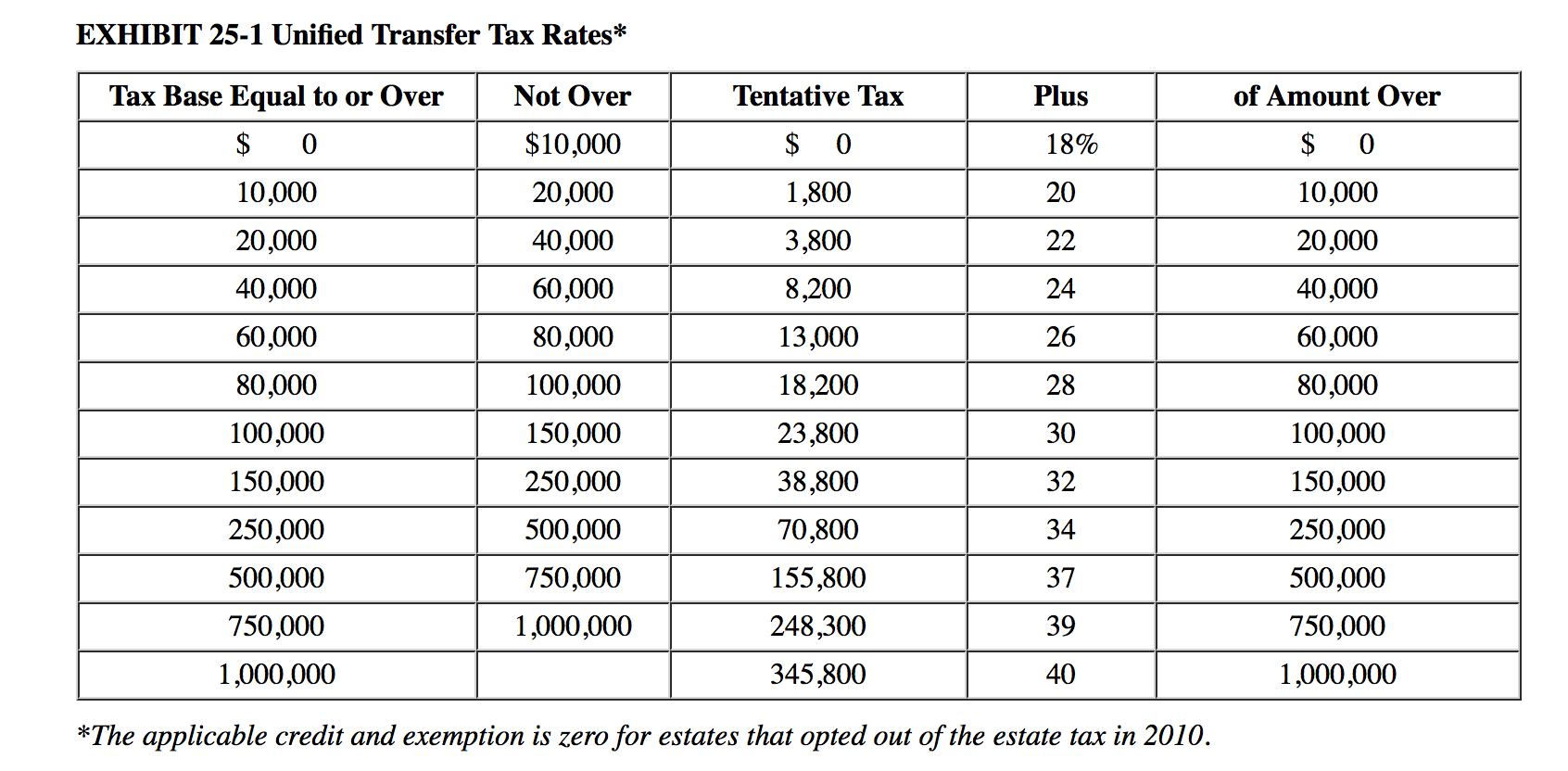

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

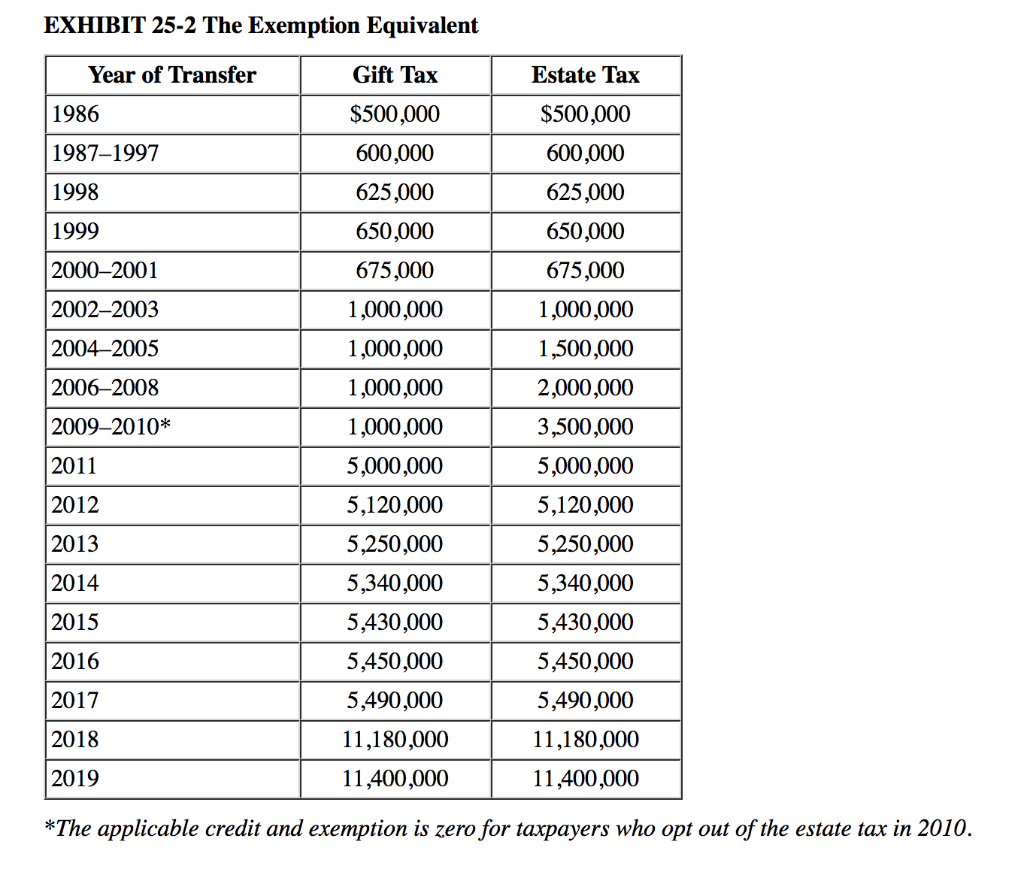

Your estate tax exemption will be reduced if you made any taxable gifts during your lifetime that exceeded the annual exclusion from gift taxes 15000 in 2021 increasing to 16000 in 2022 and if you did not pay the gift tax on those transfers at the time.

. The federal estate tax exemption is transferable between spouses meaning that if the second spouse in a married couple dies in 2022 their estate can effectively have a 2412 million exemption. The Maryland Estate Tax-Unified Credit Act altered the unified credit used for determining the amount that can be excluded for Maryland estate tax purposes. Life insurance proceeds are tax-free to some extent but that isnt always the case.

Death benefits arent normally subject to income tax but they can add to the value of the decedents estate and become subject to the federal estate tax. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due. The 117 million exemption applies to gifts and estate taxes combinedwhatever exemption you use for gifting will reduce the amount you can use for the estate tax.

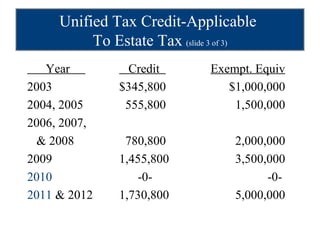

It will be equal to the difference between the total exemption available less the value of your lifetime gifts that. The unified credit is equal to The amount that can be excluded for decedents dying on or after January 1 2019 is 50 million.

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Unified Tax Credit What Is The Unified Tax Credit And Why You Should Care Waldron Schneider

![]()

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Estate Planning 101 Presentation In 2021 Estate Planning How To Plan Estate Tax

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is The Unified Tax Credit How Does It Change Federal Gift And Estate Taxes

U S Estate Tax Exposure For Canadian Residents Who Are Not U S Citizens Manulife Investment Management

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

Chapter 2 Modernizing The Tax Policy Regime In Modernizing China

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/WhatIsaUnifiedTaxCreditAug.92021-f598bf82c87b42a7b139f10953ad3850.jpg)

/vault-1144249_1920-dd5f13b69371488bb2f354e6eca08b28.jpg)